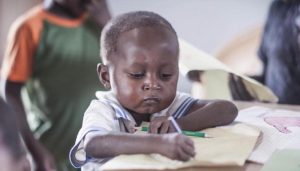

Last month, Jake Amo, a five year-old boy from Asempanaye became an internet sensation. A funding initiative had been started by Solomon Adufah to raise $20,000 to support his education. That is an example of Crowdfunding.

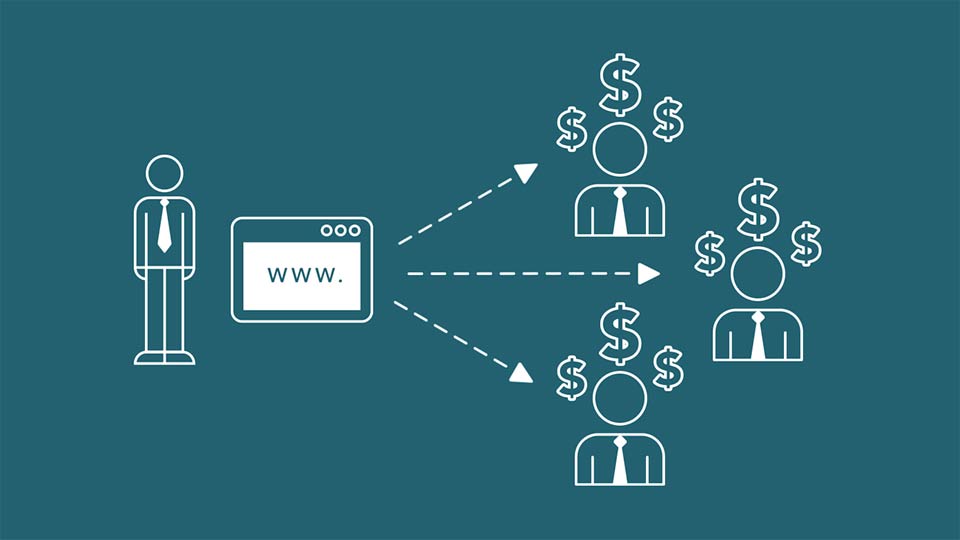

What is Crowdfunding?

It is basically raising capital from a large group of people using the Internet. In 2015 alone, campaigns all over the world raised over $34.4 billion.

Individuals, groups, and organizations crowdfund to change both their lives and the lives of others, bring dreams into reality, and unite communities through outpourings of love and monetary support. In the world of tech, many startups and companies, even Ubuntu, have ventured into crowd funding as a means to raise money to fund projects. Pebble Time, the makers of Pebble smartwatches raised $20 million through crowd funding efforts.

Raising money online used to only be popular in the Western world, but Africans, who have been communally raising money from friends, family, and sometimes strangers offline for centuries, are now beginning to embrace online fundraising.

Sounds nice. What are some crowdfunding efforts in Africa?

As of 2015, Africa had 57 active crowd funding platforms which collectively raised $32.3 million.

Crowdfunding platforms in South Africa raised the most money (about $30.8 million), followed by those in Egypt with almost $900,000, with Nigerian platforms raising a little over $300,000. The market has enormous potential and is set to increase with each passing year; the World Bank estimates the overall market potential of Sub-Saharan Africa’s crowd funding market to be $2.5 billion by 2025.

And in Ghana?

Ghana’s crowdfunding industry is growing quickly and has a very bright outlook, what with the increasing number of debit cards and the emergence of mobile money as a popular form of making payments online. Crowdfunding is an increasingly popular way for Ghanaians to make their dreams, business goals, and political aspirations come true.

For instance, aspiring Ghanaian Olympic swimmer Ophelia Swayne raised over $10,000 from 106 people to attend a qualifying meet for the Rio Olympics 2016.

Popular Ghanaian spice maker Essie’s Indiegogo campaign raised almost $20,000 in October. Essie was crowdfunding to take her spice production to the next level and over 123 people put money towards her dream.

More recently, an artist called Solomon Adufah who worked with Jake Amo, who became a popular meme, raised over $13,000 from 600 people to support Jake’s education.

Multiple-award winning blog, Circumspecte, has predicted that crowdfunding will become a campaign tool for general elections in Ghana as more political campaigns invest in robust social media presences. The opposition National Patriotic Party (NPP) makes it possible for supporters to make Visa, MasterCard and mobile money donations via the “I Am For Nana” app and party and campaign websites. Supporters can also donate GHC1.00 daily or weekly to NPP and the Akufo Addo presidential campaign via SMS, introducing crowdfunding into the hands of everyday Ghanaians.

Types of Crowdfunding

Donation-based

Donations made are philanthropic. These websites are best for personal and social causes, such as Jake’s and for charities and NGO’s. Some examples of donation-based crowd funding websites are Fundraising Africa and GoFundMe.

Reward-based

Reward-based crowd funding entails donors contributing to a campaign in exchange for a perk or a pre-order of a product. This type of funding is therefore best for products or new business ideas. Some of the most popular reward-based crowd funding websites are Kickstarter, Indiegogo, and Ulule.

Investment/Equity-based

Investment-based crowdfunding means that an investment, most often with interest rates or an ownership stake in the business, is made in a business venture. Investment crowdfunding campaigns are typically at least several months long and are best for startups seeking $100,000 or more in funding. Examples of investment-based crowdfunding websites are AngelList and EquityNet

Lending-based

Lending-based crowdfunding allows entrepreneurs to raise funds in the form of loans that they will pay back to the lenders over a set timeline with a set interest rate. Such platforms are for startup entrepreneurs who don’t want to use investment-based platforms because they don’t want to give up shares in their company immediately. Examples of lending-based crowdfunding websites are Lending Club and Funding Circle.

Conclusion

Crowdfunding presents an opportunity for Africans to support each other with our own funding. If you’re interested in making a personal project, a business idea, or a charity cause come true, consider setting up a crowdfunding campaign.

Featured image credit: linkedin.com